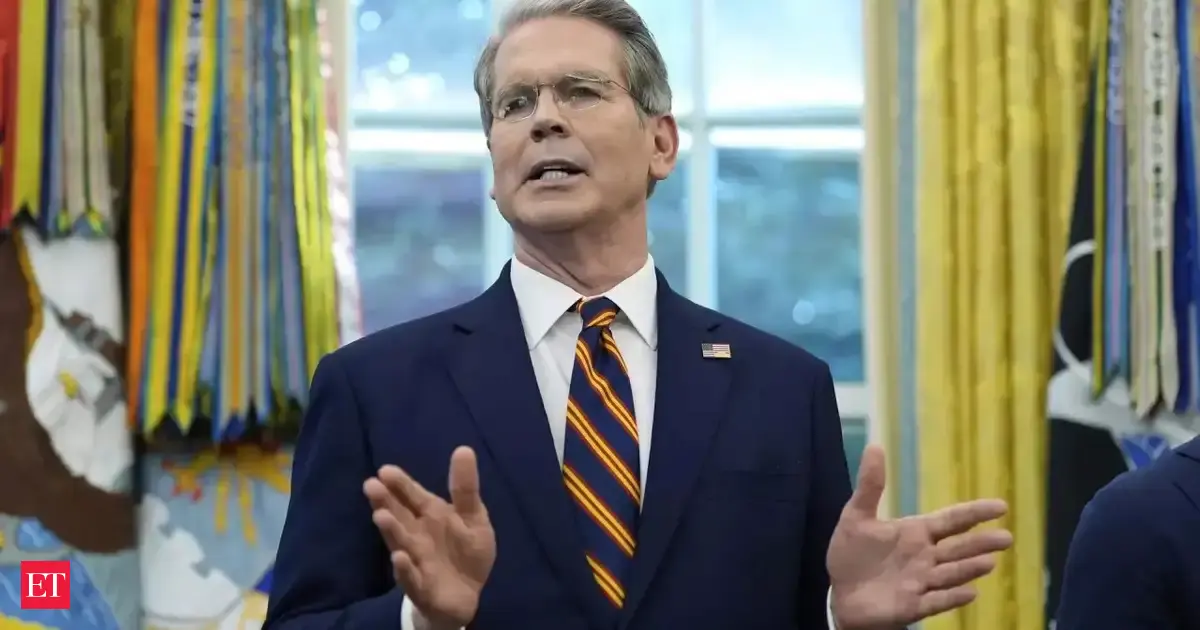

SEBI’s board meeting on Friday may have skipped any immediate changes on weekly expiries or extending the tenure of derivative contracts, but the speculation is far from over. SEBI Chief Tuhin Kanta Pandey said a consultation paper would be released in due course, keeping alive the possibility of tweaks in the coming months.

According to a Nuvama Institutional Equities report dated September 13, the imminent SEBI paper on index derivative tenures could significantly alter the earnings trajectory of exchanges, particularly BSE, the only listed one. The changes under consideration could involve shifting expiry days, moving to fortnightly or monthly cycles, or tweaking contract sizes. Nuvama cautioned that limiting expiries would be the most damaging and modelled five possible outcomes for BSE’s earnings:

Scenario 1: Different day, fortnightly expiry

If BSE retains Thursday expiries and NSE sticks with Tuesday, but only fortnightly contracts are allowed, BSE’s average daily premium turnover (ADPTV) would halve to Rs 66,000 crore. That translates into a 26.8% cut in FY27 earnings per share (EPS).

Scenario 2: Different day, monthly expiry

Restricting expiries to once a month, with each exchange having a different day, would hit BSE harder. ADPTV could slump 77.5% to Rs 33,000 crore, leading to a 36.6% EPS cut.

Scenario 3: Mid-month and end-month alternating expiry

If BSE handles mid-month and NSE takes the end-of-the-month, both on the same weekday, the overall market would shrink, but BSE could pick up some share. Still, its ADPTV could fall 46% to Rs 80,000 crore, trimming EPS by nearly 20%. In this, contracts will be month-long, but expiries will have about a two-week gap.

Scenario 4: Same day, fortnightly expiry

Both exchanges offering fortnightly expiries on the same day would shrink BSE’s ADPTV by 66% to Rs 50,000 crore by FY27, implying a 32% EPS hit over the same period.

Scenario 5: Same day, monthly expiry

The worst case, according to Nuvama, is if both NSE and BSE are limited to a single monthly expiry on the same day. BSE’s ADPTV could collapse by over 80% to just Rs 29,000 crore, eroding EPS by 38.5%by FY27.

“We are not building in any benefit of potentially higher trading volumes on leftover expiry days due to fewer overall total expiry days. We are mindful that exchanges will have room to raise charges and mitigate this hit; overall impact may thus be lower,” the Nuvama note added.

Despite these risks, the brokerage has retained its ‘Buy’ rating on BSE with a target price of Rs 2,820, valuing it at 45x Sep-27 earnings plus the value of CDSL. However, the brokerage added that it will revisit the numbers once clarity emerges on the matter.

SEBI Crackdown

Sebi has been reigning down on the options market since the past one year after multiple surveys pointed to heavy retail losses.

The capital markets regulator first floated the idea of extending the maturity and tenure of derivative contracts last month. The regulator has recently rolled out a fresh set of measures to strengthen the market, including moving to a delta-based calculation of open interest as opposed to notional open interest.

This measure has an impact on all the large market participants and could potentially make a longer-term impact on volumes and reduce volatility in the market.

At about 10 am, shares of the company were trading at Rs 2,219, higher by 0.8% from the last close. The stock pared early gains as it touched an intraday high of Rs 2,254 or 2% higher. BSE shares have had a strong run, up almost 70% in the last six months.

(Disclaimer: Recommendations, suggestions, views and opinions given by the experts are their own. These do not represent the views of The Economic Times)

.png)

German (DE)

German (DE)  English (US)

English (US)  Spanish (ES)

Spanish (ES)  French (FR)

French (FR)  Hindi (IN)

Hindi (IN)  Italian (IT)

Italian (IT)  Russian (RU)

Russian (RU)

Comments

Get the most out of News by signing in

Sign In Register